Loan Modifications

Your Loan Modification Pipeline Software Solution

Starting at $25 /User /Month

Our Loan Modification Pipeline Software solution is designed explicitly for loan mod professionals, like mortgage attorneys, mortgage servicers, foreclosure defense attorneys, and loan modification companies of any size who need loan modification pipeline software. No unique customization or extra costs are involved.

Manage your clients, employees, and your entire brokerage. CaptaFi is easy to use and affordable. Add the Loan Modification vertical and other modules like Bankruptcy and Residential Property Loans to build your suite of CaptaFi solutions. Create a CaptaFi account today and boost your agency's productivity.

CaptaFi, with its specifically designed industry data collection, built-in e-signature, phone system, and more, allows your brokerage or agency the versatility to use our system for loan modifications, loan origination, loan tracking, loan processing, storage compliance, as well as a CRM and Agency Management.

Great for mortgage attorneys, mortgage servicers, mortgage lenders, foreclosure defense attorneys, loan modification companies, brokerages, agencies, document processors, loan officers, etc...

The C.A.S.E. for choosing captafi - Loan Modification

Convenient: As a loan mod pipeline software solution, you can access Captafi from any browser or cell phone. In addition, add and delete users on the fly with our admin tools. CaptaFi can grow with you as your business grows.

Affordable: Captafi is aggressively priced to allow even single-user subscriptions with unlimited access. Furthermore, easily add users with no binding contracts. Simple pay-as-you-go pricing.

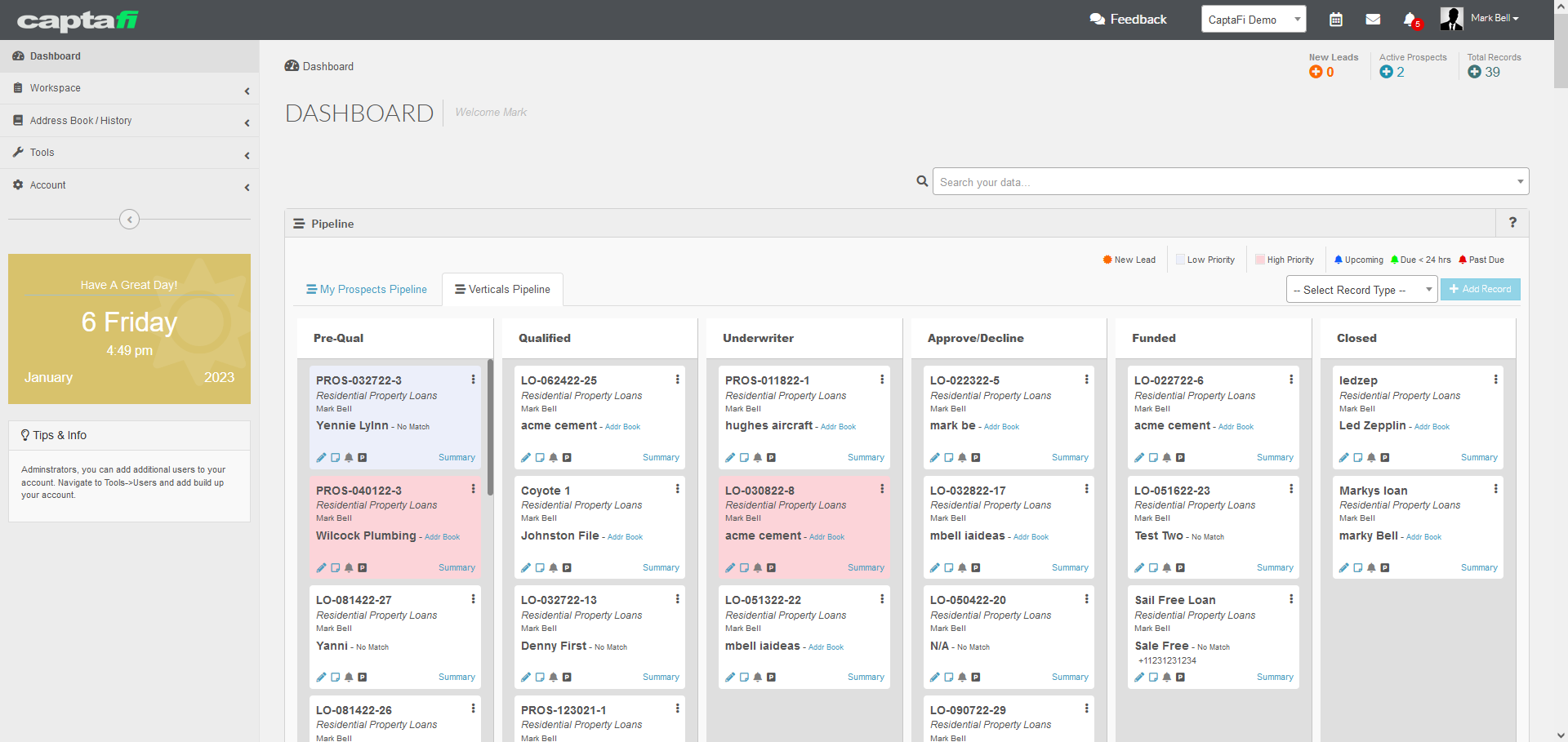

Simple: No software to install or maintain... just sign up, set up and go! The easy-to-navigate console gives you quick status of your leads, loans, or mortgage pipeline at a glance. Track and maintain your entire pipeline without messy whiteboards, spreadsheets, or confusing email trails. Make loan tracking easy.

Effective: View your leads and loan pipeline anytime. Track the entire client process from when a lead is generated until a loan mod record is closed. Easily prioritize leads and monitor activity. With color-coded aging indicators and configurable alerts, you can quickly act on loans that have reached critical dates.

Contact us for Enterprise Features and Pricing.

Screen Shots.

CaptaFi Desktop

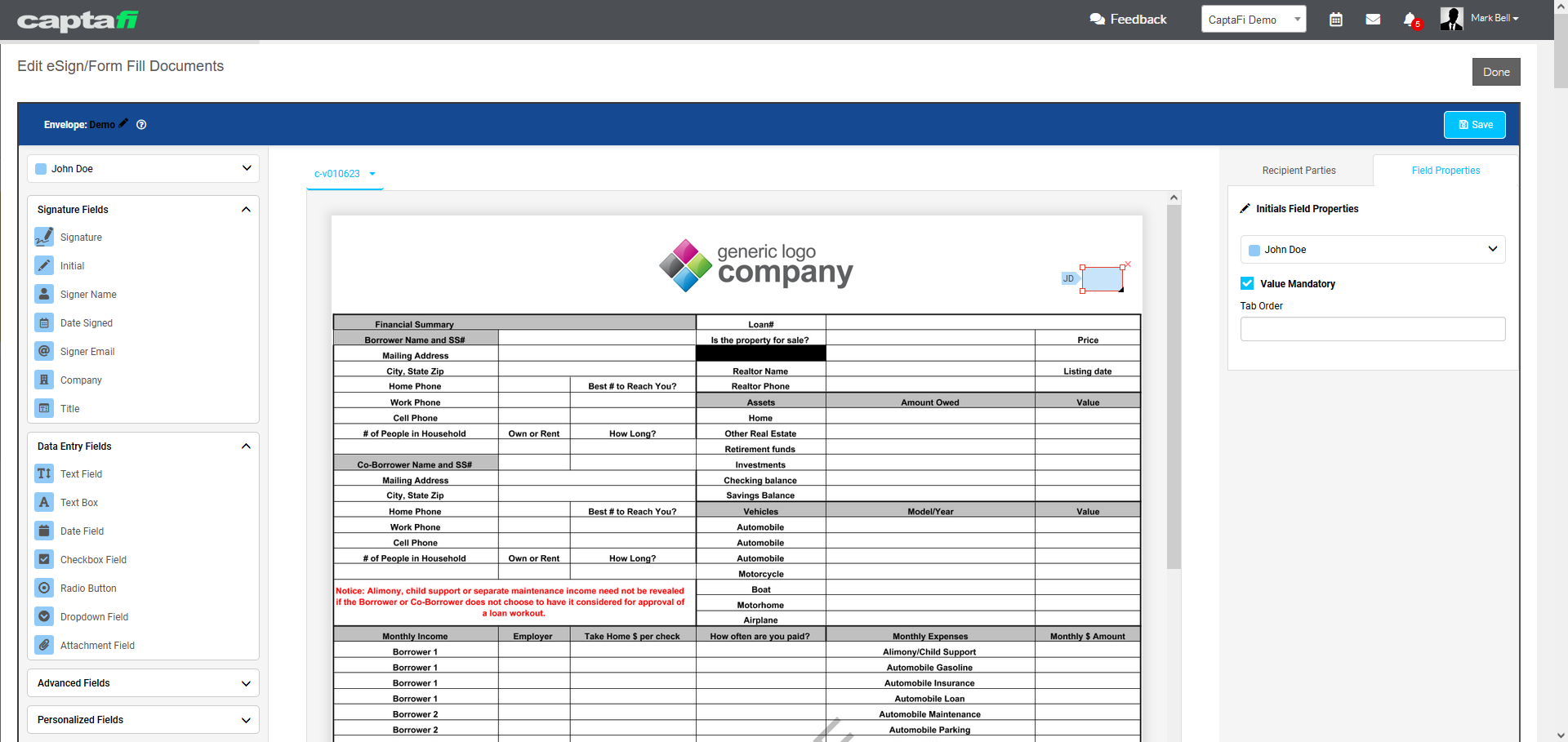

CaptaFi built-in e-Signature

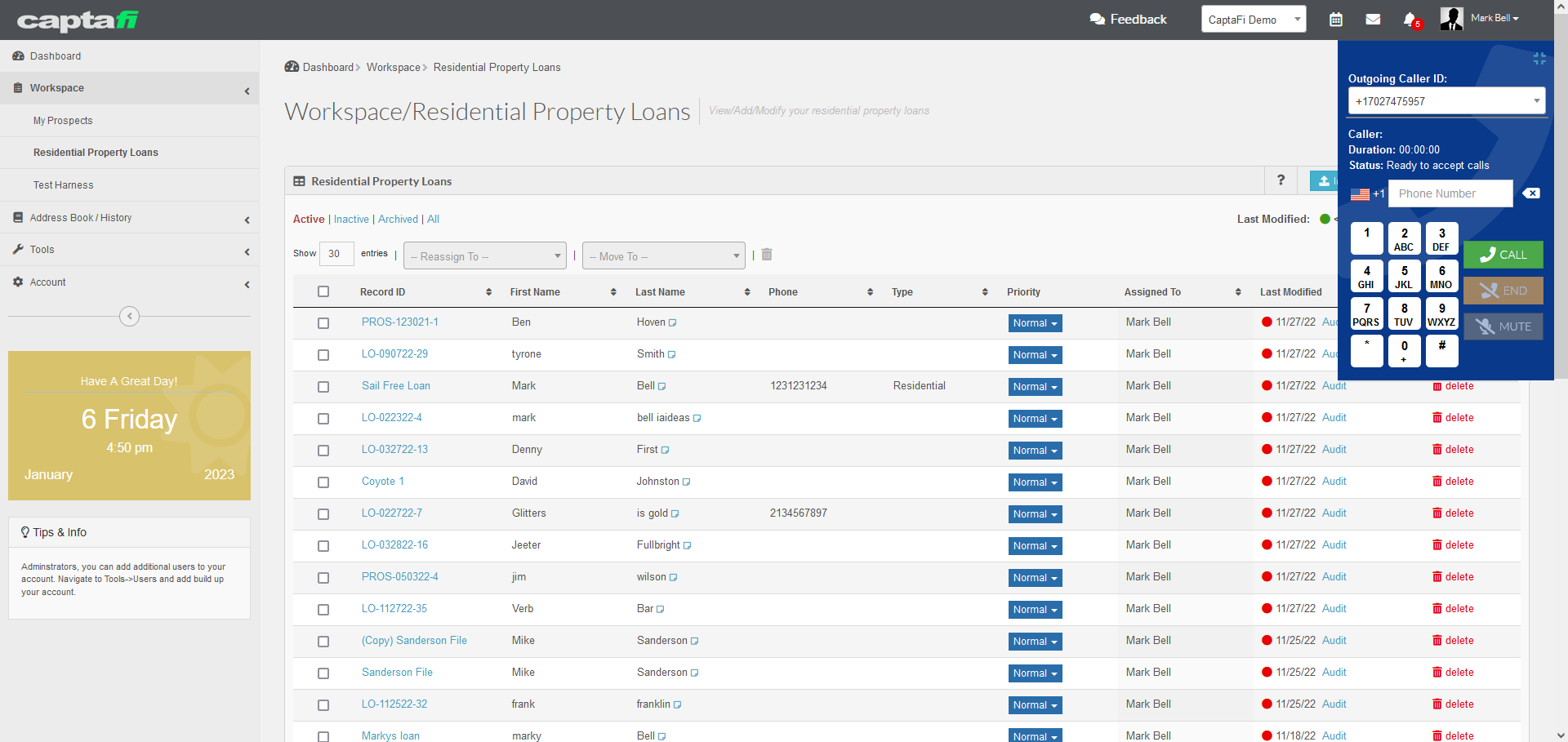

CaptaFi w/ Phone enabled

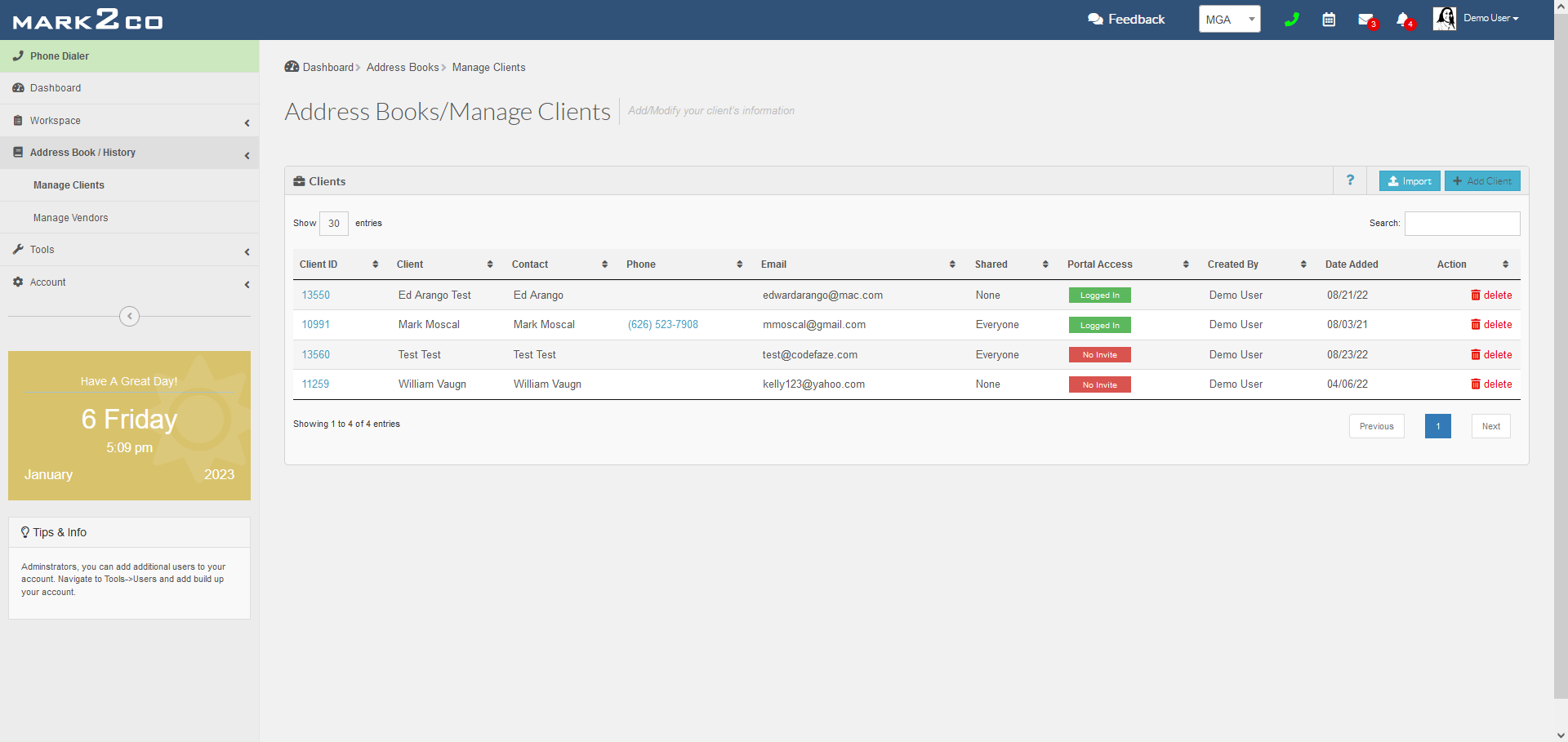

CaptaFi White Labeled

Organizing your loan mod agency towards success.

Features.

Unlimited Records

Unlimited lead and loan records means you can import your entire book of business without any extra fees.

My Prospects

Use the CRM portion of our app to work your leads and prospects. When a prospect converts to a customer, easily move their data to start a loan mod record.

Verticals

Add specifically designed business verticals such as loan modification to complete your CaptaFi Suite of features.

Share Documents

Attach and share files easily between staff. Use the customer portal to share documents with your clients.

Integrated Phone System

Outbound and inbound calling from within the application. Purchase your own toll-free number and receive inbound calls and SMS texts. Pay only for the minutes you use. Contact us for more information.

Built-In eSignature

Built-in eSignature module. Send documents to your client for signature for only $1.50 per document.

Permission Groups

Use permission groups to allow users to access, view, or edit data. Administrators can view all the records, and staff can only view records assigned to them.

Tasks and Calendars

Schedule Reminders, Due Dates, and Meetings. Share your calendar with your team to collaborate and be on the same page.

Customer Portal

Clients can access a secure portal to upload and download documents. Great for Loan Mod Attorneys and Agencies.

Import / Export

Easily import and export your data. No Fees for basic CSV imports or exports. Take your data with you if you leave.

Address Book

Import your contacts into the Address Book. Start a new Prospect or a Loan Mod Record right from the Address Book. Collect and share contact information and record history with your team.

Security

We are PCI compliant. Your data is encrypted and backed up daily. In addition, use permission groups to control who has access to which records. Enterprise clients have access to IP filtering.

Access Your Data Anywhere

A secure cloud-based application allows you to access your data anywhere safely and securely using your computer or mobile device.

Simple to Use

Designed to be simple to use. See how our Loan Modification Software is already configured to begin tracking your loan mod records now.

And More

Get Free* feature upgrades to your account automatically.

*Not applicable to features with consumables (phone minutes, e-signature fees, etc).

Enterprise Features.

Customized Branding

Customize CaptaFi with your business logo and colors. Boost your business visibility and customer experience through branded emails and client portal.

Email (D.R.E)

Direct Record Emailing. Send and receive emails directly to the customer record. Capture and organize your email conversations with your clients.

Security

Restrict access with custom security settings through I.P. Address filtering.

API

Integrate with CaptaFi to accomplish tasks such as capturing leads from your website to your account.

Volume Pricing

Contact us for volume subscription pricing.

Onboarding & Training

Our U.S. based staff can assist you and your team in setting up your CaptaFi account.

Contact us for Enterprise Features and Pricing

Use Cases.

Here are a few use-case scenarios CaptaFi can accomplish.

Solution: A private lender uses CaptaFi, Loan Origination Software, and needs a signature from a client.

1. The lender searches for a client and navigates to their record.

2. The lender creates a new e-signature job and provides the necessary data, including pdf(s) and recipients needed for signature.

3. The lender makes adjustments to the pdf, such as adding a signature field, signature date field, and any other required fields needed for the e-signature job.

4. The lender sends the e-signature job to the client through CaptaFi.

5. Client completes the signature, and all parties involved are notified that the job is complete.

6. The lender navigates back to the client's record, where they can view, download, and archive signature documents for later use.

Solution: A Bankruptcy law firm uses CaptaFi Bankruptcy Pipeline Software to streamline its process for handling clients. The software allows the law firms clients to upload important documents to their record.

1. An attorney or assistant creates a new bankruptcy record.

2. The attorney or assistant associates a client to a record and allows client portal access .

3. The attorney or assistant, sends an email invitation for the client to access a secure client portal.

4. The client clicks on the link and provide secure credentials to access their record information .

5. After logging in, the client clicks on their record and uploads the necessary documents required by the bankruptcy law firm.

6. When the client is finished the attorney or assistant can then retrieve the associated client record and view the recently uploaded files..

7. This process can be repeated for the same or other clients making the process easier for the bankruptcy law firm.

Solution: A commercial brokerage uses the CaptaFi CRM portion of its pipeline management software to contact a list of customers using the built-in phone system for improved communication and data collection.

1. An administrator of the CaptaFi account enables the built-in phone system.

2. Users navigate to your dashboard or vertical workspace to generate a list of client records.

3. The agent then clicks on a client's phone number launching the built-in dialer and phone system calling the client.

4. As the agent converses with the client they can simultaneously collect data such as notes and set task reminders for that client.

5. When the conversation is complete, the user can move to the next client in the list and start the entire process.

6. This process can continue until the user completes the list of clients they need to contact.

7. The manager continues to monitor the progress of the mortgage process through CaptaFi, ensuring that all necessary steps are completed on time.

Solution: An brokerage uses CaptaFi Agency Management Software to streamline the process of handling prospects. The software enables the brokerage to efficiently review and assign leads, ensuring each prospect receives timely and appropriate attention.

1. A loan prospect fills out a form on the broker's website, providing details about their mortgage needs and contact information.

2. CaptaFi automatically captures this data and creates a new prospect record.

3. The brokerage manager is alerted and logs into CaptaFI to review the record, assigning it to themselves or to another agent based on expertise and availability.

4. The assigned agent receives a notification and begins working with the prospect to gather additional information and assess their mortgage needs.

5. The agent uses CaptaFi to track progress and keep the brokerage manager updated on the prospect's status.

6. If the prospect decides to move forward, the agent uses the software to collect and manage the necessary data and documents to complete the quoting or sales process.

7. The brokerage manager continues to monitor the client’s progress through CaptaFi, ensuring all required steps are completed on time.

Try our Loan Modification CRM-Tracking Software - Free 14 Day Trial

Security.

- Database Encryption - Your private information, as well as all of your client data, is encrypted to ensure privacy and protection.

- Privacy - All of your personal information (including your e-mail address) is private and will never be sold or shared with any external parties. In addition, your client data is 100% yours. Furthermore, no one else can see it or use it, including CaptaFi Staff. And if you leave, you take your data with you.

- User Permissions - Permission groups are available within CaptaFi to allow or deny users access to your client data. As a result, if you wish to prevent certain employees from viewing or editing your client data, you may do so using Permission Groups.

- Export Utility - In the event that you wish to maintain a private backup of your data, an Export utility is available, which allows you to extract all of your lead, residential property loans client data, and contact information. This can also be useful for importing into another CRM software application.

Starting at $25 /User /Month

- 14- Day Free Trial

- Add Your Entire Team

- No Credit Card Required

- No Basic Import or Export Fees

- Cancel Anytime