The Looming Storm: Economic Uncertainty and its Impact on Financial Professionals

The U.S. economy is currently facing a period of significant uncertainty. Inflation is at a 40-year high, interest rates are rising, and the stock market experiences volatility. These factors raise concerns about a potential recession, which would undoubtedly lead to increased financial hardship for many Americans.

A recessionary environment would likely see a surge in demand for the services offered by financial professionals specializing in debt relief, bankruptcy, and foreclosure defense. However, are these professionals equipped to handle a significant influx of clients effectively?

The Struggle is Real: Challenges of Managing a Client Surge

Financial professionals in debt relief, bankruptcy, and foreclosure defense often manage complex cases with tight deadlines. When faced with a sudden increase in clients, these challenges can become overwhelming:

- Increased Workload: More clients mean more paperwork, case management, and communication demands, putting a strain on resources.

- Time Management Mayhem: Attorneys and counselors may struggle to dedicate sufficient time to each client if their caseload explodes.

- Communication Breakdowns: Maintaining clear and consistent communication with a larger client base can become increasingly difficult.

- Compliance Maintenance: The pressure of managing a heavy caseload can lead to errors and mis-filing during compliance archiving.

These challenges can negatively impact both the quality of service provided to clients and the overall well-being of the professionals themselves.

Client Management Software: A Powerful Ally in Uncertain Times

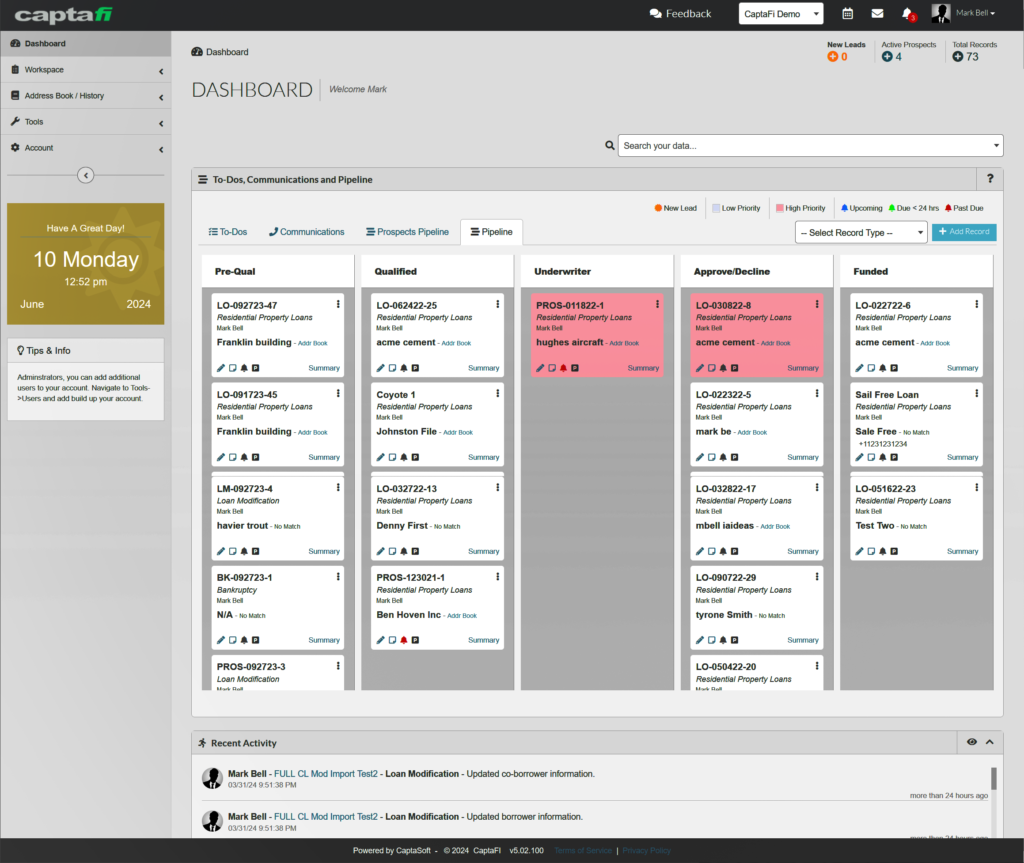

Client relationship management (CRM) software and agency management software can be powerful tools for financial professionals navigating an economic downturn. Here's how these tools can address the challenges mentioned above:

- Streamlined Workflows: CRM software automates repetitive tasks like scheduling appointments, sending emails, and generating reports. This frees up valuable time for client interaction and case strategy development.

- Organization Made Easy: Client management software provides a central platform to store and organize client information, documents, and case notes. This ensures easy access to critical information and promotes a more organized workflow.

- Enhanced Communication: CRM software facilitates communication with clients through features like email automation, secure document sharing, and online client portals.

- Collaboration is Key: Many CRM systems allow for team collaboration, enabling seamless communication and information sharing between attorneys, paralegals, and other staff members working on a case.

- Data-Driven Decisions: CRM software provides valuable data and analytics on client interactions, case progress, and overall firm performance. This data can be used to identify areas for improvement and optimize client service strategies.

CaptaFi and Beyond: Features Tailored for Financial Professionals

CaptaFi and other software solutions designed specifically for financial professionals like Real Estate attorneys and Debt Counselors offer additional features that can be particularly beneficial in the context of debt relief, bankruptcy, and foreclosure defense:

- Industry-Specific Tools: These software options often include features like automated lead capture, bankruptcy petition preparation tools, and integration with credit reporting agencies.

- Compliance Assistant: The software can help ensure compliance with relevant regulations and automate tasks associated with document management and case filing.

- Scalability for Growth: CRM and agency management software solutions are designed to scale with your business. As your client base grows, the software can adapt to accommodate the increased workload.

Investing in the Future: Why Now is the Time for Financial Management Software Adoption

The economic outlook might be uncertain, but one thing is clear: financial professionals who specialize in debt relief, bankruptcy, and foreclosure defense need to be prepared for any potential surge in client demand.

By implementing client management software like CaptaFi, these professionals can streamline their operations, improve communication, and ultimately deliver better service to their clients during challenging economic times.

Investing in the right software now can position your firm for success, allowing you to navigate economic uncertainty with confidence and provide much-needed assistance to those facing financial hardship.